Stability

Grounded in strategic leadership, prudent oversight, and sound governance.

$3.4 Billion

Assets in the York University Pension Fund managed by York's pension investment team

10,000

Number of active and retired York employees who benefit from pension security

Governance Roles & Responsibilities

The York University Pension Plan provides pension income to its retired faculty and staff. York University is the plan sponsor and the plan administrator, fulfilling these roles through York’s Pension Governance structure.

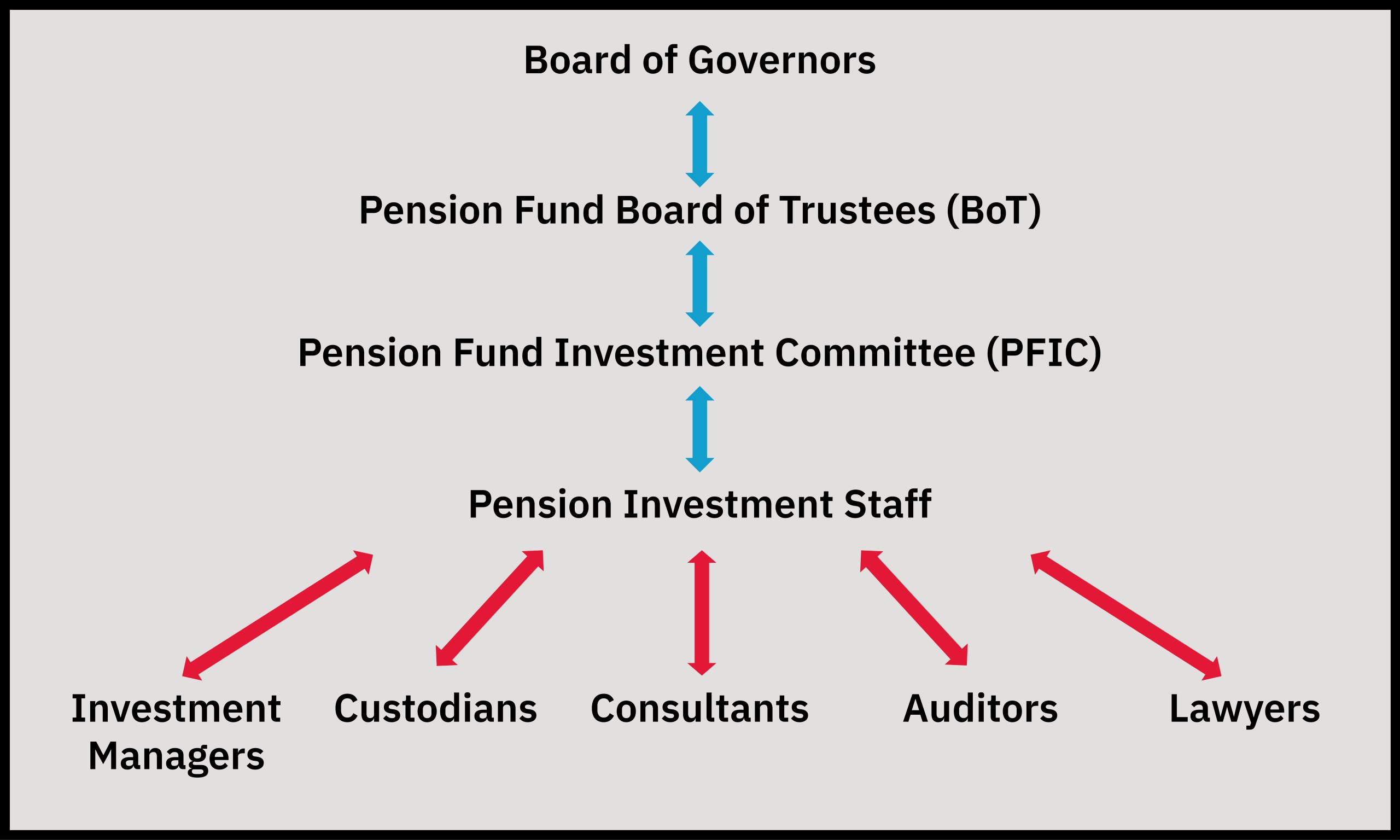

Board of Governors

The University acts through its Board of Governors, relevant board committees, and the Pension and Benefits department to discharge its benefit administration duties. The board has appointed a Pension Fund Board of Trustees to act as a trustee of the pension fund and discharge the fund investment responsibilities.

Pension Fund Board of Trustees

Appointed to discharge fund investment duties, trustees are nominated from a variety of stakeholder groups across the University.

Pension Fund Investment Committee

Appointed by the Board of Trustees to help carry out duties with respect to the investments of the Fund, PFIC is made up of both internal and external investment experts.

Pension Investments Office

Assists the Pension Fund Board of Trustees and the Pension Fund Investment Committee in carrying out the administration and oversight of the York University Pension Fund and manages the day-to-day pension fund operations.

Learn more from the York University Pension Plan’s Director, Pension Fund.

The York University Pension Fund holds itself to the highest of standards, taking a balanced approach to investing that’s informed by our fundamental fiduciary duties to manage the fund:

- in a reasonable, prudent, impartial manner

- with honesty and in good faith

- avoiding conflicts of interest

- with the best interest of plan members first and foremost guaranteeing retirement entitlements are there when members need them