A balanced approach to investing that's stable, secure, and sustainable.

The York University Pension Fund delivers value to members in a progressive manner that minimizes risk, encourages growth, and aligns with the University’s commitment to sustainability. Our investment strategy emphasizes a holistic, balanced approach to investing that is stable, secure, and sustainable.

Stable

The fund's disciplined risk management and long-term growth strategy provide risk/reward trade-offs that manage volatility and provide stable returns.

Secure

The fund secures pension benefits with a focus on downside protection, making it resilient to changing market conditions.

Sustainable

The fund takes a sophisticated, socially conscious approach that integrates ESG factors and long-term vision to provide both solid returns and growth.

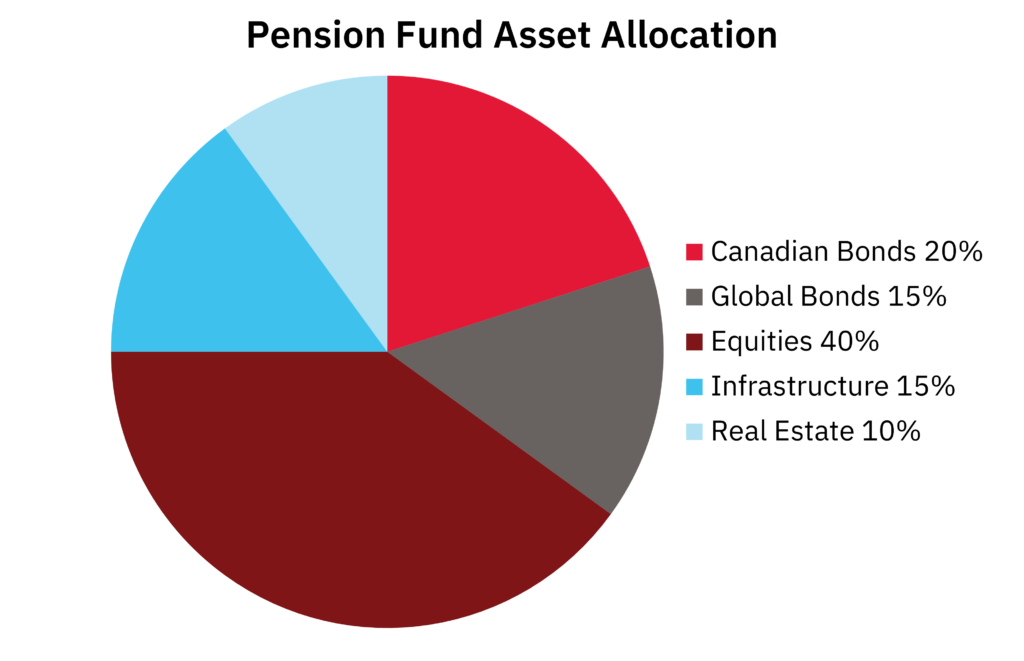

A Diversified Asset Mix

Thoughtful diversification is the key to keeping the Pension Fund stable and optimized. The investments team has devised the fund portfolio with careful consideration of the asset types, markets and sectors, and how they work together, so the fund is resilient to different economic and market conditions.

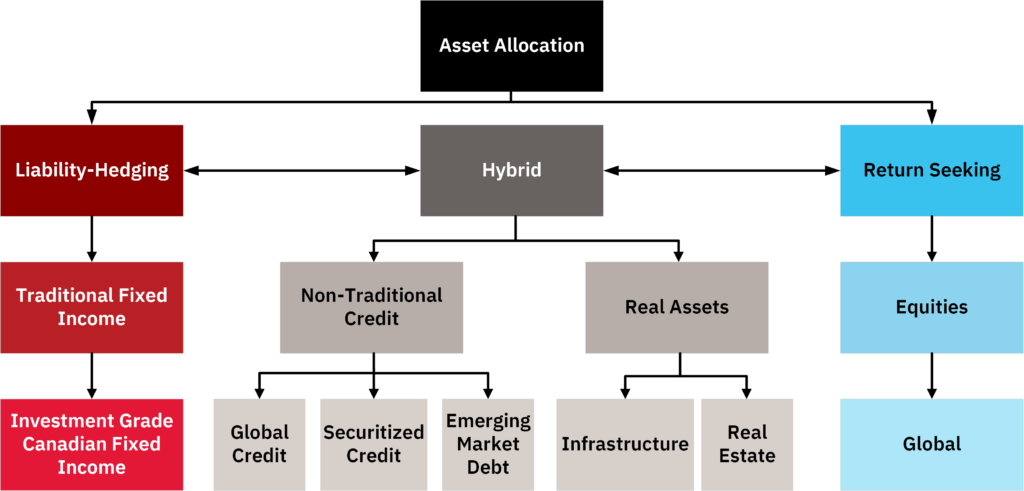

Optimized Asset Allocation

Securing pension benefits means that the overall fund strategy must balance the University’s resources as well as the fiduciary responsibility of the pension liabilities and obligations. This means targeting an appropriate risk-adjusted return while managing the ‘mismatched’ risk inherent in hybrid plans.