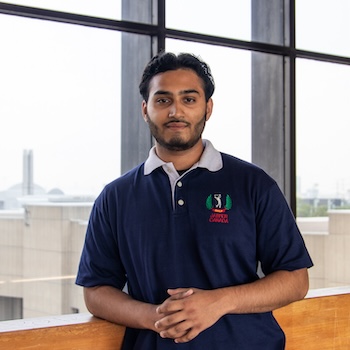

Mohammad Fadil Siddiqui

DARE Project: Decoding Excess Returns: Cost of Equity in Canadian Markets

Program(s) of Study: Bachelor of Commerce Honors (Major: Finance)

Project Supervisor: Saikat Sarkar

Through my research, my primary aim is to create a foundation for undergraduate students to critique, improve and create better methods for determining the cost of equity for firms.

Project Description:

For my DARE research project, I analyzed the Capital Asset Pricing Model (CAPM), a cornerstone in understanding the risk-return relationship in equity markets. The project's primary goal was to evaluate the accuracy of CAPM in producing reliable estimates. To answer this, our analysis involved two main cohorts that must be investigated. The first goal was assessing how varying market proxies can produce historical rates of returns, a challenge first posited by Richard Roll. Based on the portfolio of assets investors follow as a benchmark, risk premiums for assets can look very different. Therefore, the aim is to find evidence on which proxy (local vs international markets) influences investor returns and to understand if the Canadian market benefits from global integration through reduced systematic risk. The second aim was to move beyond market risk, to include the Fama-French five-factor model and the momentum effect. The hope is to understand if there are additional systematic risks, inefficiencies and anomalies that are specific to the industry's structural characteristics. To achieve this, I had a few responsibilities that occurred sequentially. The first step was gathering relevant data from the Kenneth French Library and the Global Financial Database, focusing on seven selected industries and the overall market returns we would like to test. Having the relevant data, my second step was to use the Canadian stock market information and apply an ordinary least squares (OLS) regression analysis to estimate parameters that can help support our findings. We want to find how sensitive industry returns are to movements in local vs global markets and how much of excess returns are unexplained by simple risk premium. Finally, the most crucial aspect was to present this data in a manner that was concise and understandable to all readers. I authored a comprehensive literature review, emphasizing the significance of our findings and what this means for the overall discussion in financial economics. Our empirical results indicate that Canadian markets are perceived to have a lower risk profile that is not reduced through global diversification. Furthermore, we found industries are unique in the structural risks that influence their respective risk premiums. Not every anomaly exists with the only consistency being that firms with robust profitability have outperformed.The Dean’s Award for Research Excellence (DARE) - Undergraduate enables our students to meaningfully engage in research projects supervised by LA&PS faculty members. Find out more about DARE.