Osgoode Investor Protection Clinic and Living Lab

OUR PURPOSE

Osgoode’s Investor Protection Clinic and Living Lab (“IPC”), the first of its kind in Canada, provides pro-bono legal services to people who believe their investments were mishandled and cannot afford a lawyer. The IPC was founded by Osgoode Hall Law School in collaboration with FAIR Canada, a non-profit organization that champions the rights of individual investors in Canada through advocacy, education, and regulatory advancements.

The IPC has received seed and other funding from the Law Foundation of Ontario, two cy-prés awards, the Ontario Securities Commission (OSC), the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association (MFDA) (now merged as Canadian Investment Regulatory Organization (CIRO)). The IPC also receives support from Osgoode alumni and in-kind contributions from our pro-bono partner law firms and experts. The IPC is grateful to these organizations and individuals for their generous support.

The IPC has three primary purposes:

LEGAL SERVICES

Provide legal advice to people

who believe they have suffered an

investment loss because of someone

else’s wrongdoing or negligence.

RESEARCH

Act as a “Living Lab,” collecting

and analyzing research data in an

anonymized way to inform public

policy.

EDUCATION AND ENGAGEMENT

Develop investor education initiatives and educational resources through community outreach.

2022 - 2023 AT A GLANCE

Legal Services

From May 1, 2022, to April 30, 3023, the IPC received a total of 69 inquiries, of which:

45

intake interviews were conducted.

15

new files were opened with 7 closed by April 30, 2023.

8

demand letters, 3 complaint letters, 2 Ombudsman for Banking Services (OBSI) complaints, 2 negotiated settlements, and 1 Small Claims Court action.

Research

Key data points from the 45 intake interviews:

21 (47%)

involved clients who are 50 years old or older,

17 (38%)

involved unsuitable advice by registered representatives,

14 (31%)

involved fraud or scam, and

9 (20%)

involved do-it-yourself (DIY) investors.

The Living Lab is collecting and analyzing this and other data for research purposes.

Education and Engagement

The IPC hosted the "Access to Justice and Fair Outcomes for Harmed Investors" conference (September 8, 2022).

Professor Catellier presented at Prosper Canada's "Investing with Confidence for Financially Vulnerable Canadians" webinar (October 18, 2022).

Professor Puri presented at Laval University - Symposium on Investor Protection (October 29, 2022).

Professor Catellier and student caseworker Adam Dickinson presented at the OSC Investor Advisory Panel (IAP) meeting (March 30, 2023).

Assistant Director Fred Maefs, student caseworker Aya Farm, and coordinator Ruby Soriano presented to the OSC Enforcement Branch (April 6, 2023).

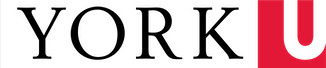

OUR WORK

* A data discrepancy in the number of Intake Interviews conducted during 2021-2022 has been corrected from the previous count

of 71 to 61.

Factors Considered in Selecting Files:

- Merits of an applicant’s complaint

- Whether a compliant fell within the scope of the IPC's mandate

- Financial needs of an applicant

- Adequate evidence and record keeping of communication

- Expiration of the limitation period

- Learning opportunity for the student caseworkers

- IPC capacity

File Work Included:

- Submitting complaints to regulators and law enforcement

- Preparing demand letters to investment firms and other opposing parties

- Submitting complaints to the OBSI

- Pursuing civil claims

- Assisting with settlements

- Determining the standard of care required for recommending an investment

- Educating clients on various complaint processes

- Investigating potential avenues for dispute resolution including alternatives to civil litigation

OEO Case Raises Alarms

“We have a role to play in educating investors and leveraging our front-line experiences to help inform public policy.”

— Professor Poonam Puri, academic director

When a 24-year-old investor hit “purchase” on $500 worth of GameStop shares through his bank’s order execution only (OEO) platform, he had no idea that he was using options trading. “He was margined to the moon,” explains Adam Dickinson, the IPC student caseworker on the file, “and lost everything without even realizing he was doing it.”

The purchase resulted in a $28,000 debt – a devastating loss for a new university graduate with a credit card limit of just $5,000.

Guided by supervising lawyer Liz McLellan of Crawley MacKewn Brush LLP, Dickinson initiated negotiations with the bank. The two parties ultimately reached a settlement agreement of $15,000, releasing the client of nearly half of his total debt.

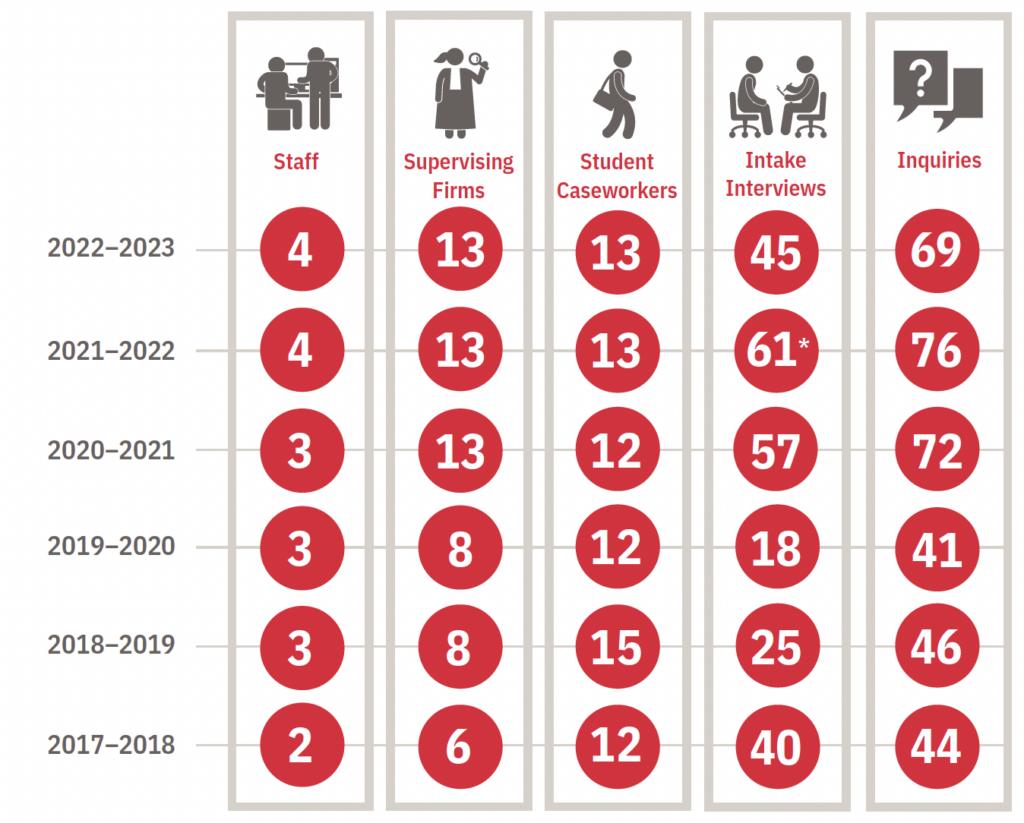

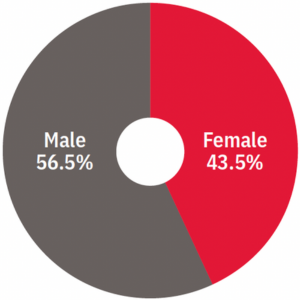

CLIENT DATA AND DEMOGRAPHICS*

Gender

Employment Status

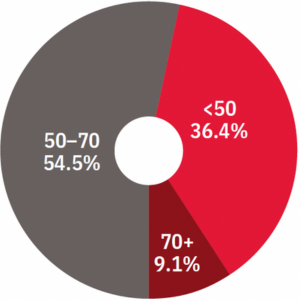

Age

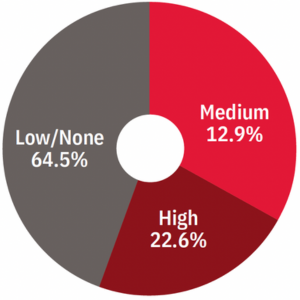

Investment Knowledge

* See all Client Data and Demographics in the PDF Annual Report available below.

The IPC has been one of the highlights of law school to date. It was a terrific introduction to the securities industry and provided an opportunity to think about the law from a multitude of perspectives. Through the IPC, I also had the chance to be mentored by terrific legal practitioners and clinical directors. The IPC allowed me to advocate for clients by negotiating with a large institutional bank and preparing a file for the Small Claims Court. These experiences and the relationships I built through the IPC will be foundational as I continue my career in law.

— Adam (2022-2023 caseworker)