June 10, 2022

By Christina Love (Undergraduate Student, Indigenous Studies and French)

Christina Love is a contributor to the GLRC’s interview series entitled Workers’ Stories in the COVID-19 Era. She was also a union organizer with Workers United at her local Shoppers Drug Mart from October 2020 – February 2021. Christina believes that education is essential to understanding the world around us so that we can better create change.

This is intended as an educational resource for workers and not as legal advice. If legal advice is required, please scroll to the section entitled ‘Labour and Legal Resources in Ontario’ and contact the relevant organization for further information. The information in this blogpost is current as of the publication date.

Introduction

Workers rights in Ontario have increasingly come under attack in recent years as politicians have been taking advantage of the COVID-19 pandemic to pass repressive legislation and ‘emergency measures’ that work to benefit businesses over workers. Another disturbing facet of this trend is the lack of regulation of the gig economy. For example, while there is a recent proposal to raise gig workers’ wages to the provincial minimum, it is only effective for time directly engaged in an assignment, not when they are on-call. If most of a gig worker’s day is spent waiting, then they will effectively not be making minimum wage. Moreover, many workers do not know their rights and how to file claims if their employer violates those rights. This is especially pertinent for immigrants and refugees who might not be familiar with Canadian laws and are thus made vulnerable to exploitation. In any case, the first step towards supportive and proactive legislation and workplaces is education, and the immediate next step is action. I hope that this blogpost can serve as an educational tool for workers.

The Employment Standards Act

The Employment Standards Act (ESA) regulates the minimum rights that all workers are entitled to, and the minimum standards that all employers must adhere to, here in Ontario. You are always entitled to these minimums, and it is illegal for your rights to be denied, even if you sign a document from your employer that states otherwise. The Act does change, from time to time, so it is wise to consult specific sections of the document itself if you are unsure about anything.

WORKERS NOT COVERED UNDER THE ACT

While the ESA applies to everyone working in Ontario, regardless of citizenship/immigration status, there are some workers who are not entitled to the benefits and protections of the Act. These include federal employees, foreign embassy/consulate employees, students doing co-op placements, self-employed workers, prisoners, workers ordered by a court to work as part of a sentence, holders of elected office, directors of corporations, police officers, members of quasi-judicial tribunals, and people who hold political, religious, or judicial office.

The most common exemption from the ESA is that of wage-based exemption, so while you are entitled to other rights, the right to minimum wage does not apply to you. Examples of these jobs/categories include:

- Farm workers

- Workers at private day camps

- People under 18

DID YOU KNOW: Servers and bartenders are now entitled full minimum wage as of January 2022.

Most workers are entitled to the full rights and benefits of employees under the ESA. If you have been told by your employer that you are not entitled to some/all of your rights, including the right to minimum wage, and you believe that this is incorrect, please seek legal advice to confirm your status.

WAGES

Minimum wage

Almost every worker is entitled to the provincial minimum wage which is the lowest amount a worker can legally be paid. The current minimum wage for most employees is $15/hour. On October 1, 2022 this goes up to $15.50/hour. For folks under 18, the current minimum wage is $14.10, which will raise to $14.60 on October 1, 2022. Employees who earn commission are entitled to at least minimum wage, so if they do not earn the equivalent or more in commission in a given pay period, their employer must make up the difference. Homeworkers, who are workers who do paid work in their own homes, are currently entitled to $16.50/hour, which will go up to $17.05 on October 1, 2022. Minimum wage applies to workers regardless of payment method (cash, cheque, direct deposit, etc.) or whether they’re full- or part-time.

Frequency of pay

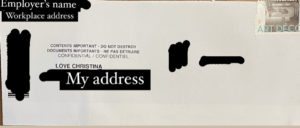

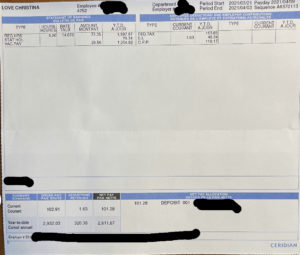

Employers must establish a recurring pay period and pay day. Wages earned during each period must be paid by the pay day. So, if your pay period is every two weeks and pay day is the second Friday, you must receive your pay by that day and no later.

Pay statements

Written pay statements must be given to employees on or before their pay day. Statements can be provided by email if the employee has access to make paper copies of them. The following information is required by law to be included on pay statements:

- The pay period/date that the wages are for

- The rate of pay, even if it is just the legal minimum

- The total, or gross, amount before deductions (unless provided in other regular documentation)

- Each deduction from the pay, including the amount and what it’s for

- If they employee gets room and board taken off, this will also need to be documented in the pay statement

- The net, or actual amount, pay that the employee takes home after deductions

DID YOU KNOW: Wages cannot be withheld, have non-legally required deductions made, or be required to be repaid to the employer except in special circumstances, usually only if there is a court order or if the employee authorizes it. Get legal advice if you are unsure!

Termination

After an employee leaves their position, the employer must pay any outstanding wages no later than seven days after the employment ends, or by the day that would have been the employee’s next pay day. Pay statements after termination of employment must include:

- The total amount of termination or severance pay the employee gets, if applicable

- The total amount of any vacation pay that the employee is owed, including how the termination and vacation pay was calculated, unless the information is provided somewhere else (e.g., it would include that termination is 15% and vacation is 4% of the total wages)

- Everything else required to be included on pay statements

Overtime

If an employee works over 44 hours in a week, they are entitled to be paid 1.5x their wage for each additional hour. That means if you are working for minimum wage and you work 50 hours in a week, your gross (total before deductions) pay is $15 x 44 + $22.5 x 6 = $795. Now, this is subject to a few exceptions depending on the specifics of the employee’s contract or agreements between employee/employer. Overtime changes if:

- There is a different agreed-upon threshold for overtime

- Overtime is defined differently in a Collective Agreement that applies to the employee

- The employee agrees to have their hours be averaged over 2-4 consecutive weeks to determine overtime entitlement

DID YOU KNOW: Unless an employee is represented by a union, contracts and agreements expire after two years in most cases.

Another consideration is that overtime can be taken as paid time off at 1.5 hours off per one hour overtime worked (e.g., if you work 10 hours overtime and get paid time off, you would be getting 15 hours off). This is only done if the employer and employee agree to it and it happens within three months of the overtime being worked, or up to 12 months if the employee agrees to extending. If the employment terminates before the employee can take the time off, any outstanding overtime must be added directly to their paycheque.

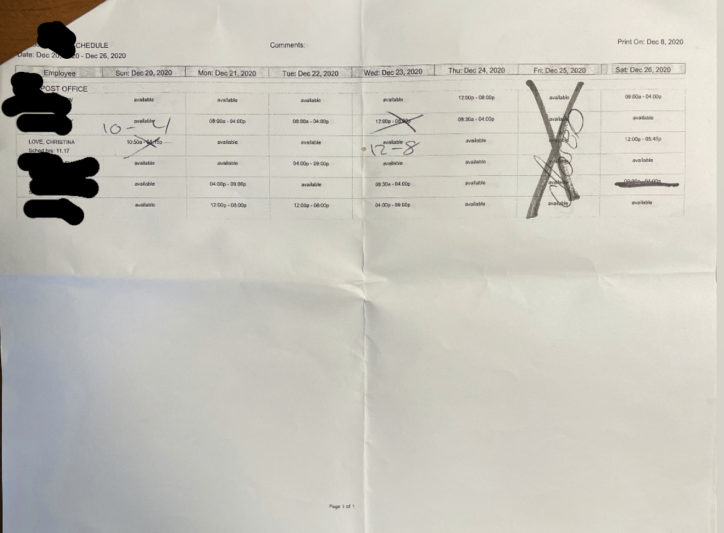

The three-hour rule

If someone who usually works more than three hours at a time is scheduled to work three hours but is not needed the whole time and is asked to go home, they are entitled to three hours of pay if they were able to work for longer. This does not apply to being asked to go home because of extenuating circumstances like power failure or extreme weather events.

TIPS & GRATUITIES

Generally, employees are entitled to keep ALL of their tips, and deductions cannot be made by the employer. Withholding tips is not a valid disciplinary measure, for example. If an employer does not follow this, it is treated as wages being withheld under the Act and legal action can be taken. There are, however, special circumstances under which tips can be withheld/have deductions made:

- Tips are pooled among all employees. The employer and shareholders do not count as employees and usually are not allowed to take tips for themselves, however, employers/shareholders are able to take part in receiving pooled tips if they do a substantial amount of the same work, or work in the same industry, as the employees who get tips. Basically, they have to do more than cover a shift every now and then to qualify for the pool. The employer only qualifies if they are the sole owner or half of a partnership.

- A Canadian court order or statute authorizes it.

If employees are unionized and their Collective Agreement has provisions concerning tips/gratuities that are different from the ESA, and they are from before June 10, 2016, the provisions from the Agreement will apply.

WORK HOURS & BREAKS

In most cases, employees are not allowed, or to be expected, to work over 48 hours per week or over eight hours per day. Exceptions are:

- If an employee has a regular workday of more than eight hours of work per week over 48 hours

- The employee freely agrees to an exception, which can be revoked by the employee if they change their mind and give their employer two weeks of notice

- Exceptions are not valid unless a manager/the employer gives the employee the most recent document that the Director of Employment Standards has created about the rights of employees and obligations of employers and the agreement states that the employee acknowledges receiving the document

- If there is an emergency

DID YOU KNOW: Agreements between employees and employers typically have to be in writing to be enforceable.

In any case, employers must give employees 11 consecutive hours free from work within a 24-hour period unless they are on-call. If an employee does shift work, employers must give them at least eight hours off between shifts. Everyone is entitled to at least one full day off per week OR at least two full days off every two weeks. Also, most retail workers can refuse to work Sundays and public holidays.

In terms of breaks, they are usually outlined in employment contracts in addition to the eating periods employees are required to get. As outlined in the ESA, employees are entitled to have at least 30 minutes to eat every five hours. Unless stated otherwise in an employment contract or Collective Agreement, the employer is not required to pay the employee during their eating periods.

VACATION TIME & VACATION PAY

Typically, after a year of employment at one place, workers are entitled to two weeks of vacation each year. After five years at the same place, they are entitled to three weeks of vacation each year. There are exceptions if the employment contract lays out something different or if an alternative is agreed between the employee/employer. Employees who have worked less than 5 years at one place are entitled to 4% of their wages as vacation pay. If they have worked five or more years at the same place, they are entitled to 6% of their wages as vacation pay. Vacation pay must be given in a lump sum before the start of vacation unless the employee wants to save their vacation pay for a later date or the employer gives the payout on or before a pay day, subject to different circumstances.

DISCRIMINATION & HARASSMENT*

*This section is taken from the Human Rights Code as it is not covered under the ESA. Regardless of the exempted jobs listed in Jobs not Covered Under the Act, every single worker in Ontario is entitled to be free from discrimination and harassment in the workplace. The claims process is different from claims through the Ministry of Labour for infractions against the ESA, so I have included that in this section as well.

Every person has a right to equality in employment. Protected demographic markers include:

- Race

- Ancestry

- Place of origin

- Colour

- Ethnicity

- Citizenship

- Religion/faith

- Sexual orientation

- Gender identity

- Gender expression

- Sex – including pregnancy & ability to become pregnant

- Age – not including anyone under 18

- Disability

- Record of offenses – not including people who work in vulnerable sectors

- Marital status

- Family status

NOTE: Poverty/economic status is not included as a protected demographic of person. I encourage you to reflect on why that is.

This means that people cannot legally be discriminated against, or harassed, by the employer, a representative of the employer, or by their coworkers because of the above reasons. Every person also has a right to equality of treatment in unions, trade/occupational associations, and any other self-governing worker’s organization. In addition, all forms of sexual harassment are illegal in the workplace. This includes soliciting an employee for sex for a career advancement or other employment benefits and, on the other side of the coin, threatening to demote or retaliate against an employee for refusing sexual solicitation for a career advancement or other employment benefits. It is illegal to retaliate against an employee for asserting their rights under the Human Rights Code.

There are a few exceptions to the Code, specifically when Canadian citizenship, age of less than 65, or certain abilities are reasonably required as a condition of employment.

The Human Rights Tribunal of Ontario is the governing body that deals with claims of discrimination and harassment filed under the Human Rights Code. Unionized employees who experience discrimination and harassment should speak with their union and file a grievance if relevant. Otherwise, employees can file a claim in court, but this may cost money. The Tribunal can be contacted at: 416-326-1312 or 1-866-598-0322.

Contact information for the Human Rights Legal Support Centre

Toll free numbers:

Toll Free: 1-866-625-5179

TTY Toll Free: 1-866 612-8627

Fax: 1-866-625-5180

Numbers for the GTA:

Tel: 416-597-4900

TTY: 416-597-4903

Fax: 416-597-4901

TERMINATION

After three months of employment, employers cannot terminate, or let go of, an employee unless the employee is given written notice and that notice has expired. Written notice differs based on number of years that an employee has been with a company:

| Amount of notice | If employed for…years |

|---|---|

| 1 week | Under 1 |

| 2 weeks | More than 1 but less than 3 |

| 3 weeks | More than 3 but less than 4 |

| 4 weeks | More than 4 but less than 5 |

| 5 weeks | More than 5 but less than 6 |

| 6 weeks | More than 6 but less than 7 |

| 7 weeks | More than 7 but less than 8 |

| 8 weeks | More than 8 |

Written notice of termination needs to be verifiably delivered to the employee to be considered valid. Email, registered mail, or physically handing the employee notice of termination are all examples of verifiably giving them notice. Now, notice is different if there is a mass termination of more than 50 employees. In this case, notice time is as follows:

| Amount of notice | Number of employees to be terminated |

|---|---|

| 8 weeks | 50-199 people |

| 12 weeks | 200-499 people |

| 16 weeks | 500+ people |

DID YOU KNOW: This notice format does not apply if the company is going out of business. In that case, notice is generally one week for under a year worked and two weeks if the employee has worked over a year.

If a mass termination is occurring, there must be a poster in a place visible to employees that outlines why the termination is happening, who was consulted, etc. During any notice periods, the employer cannot:

- Reduce wages or alter the employment contract or any other terms and conditions of employment.

- Stop making contributions to a benefit plan for the employees.

- If they fail to make benefit plan contributions that they are supposed to, the amount equal to the contribution payments missed will be treated as unpaid wages and if they are not paid, a claim for them can be filed.

- Pay employees less than average.

- Employees need to be paid the same as a regular work week if they typically would have regular hours/pay. If the employee does not have regular hours or pay, they need to be paid at least the average amount they earned in the last 12 weeks for every week during the notice period.

Termination without notice is only legal in select circumstances, namely, if the employee displays intentional misconduct, neglect of major duties, or significant disobedience. An employee can also be terminated without notice if they have worked at a place for less than three months, are a construction worker, on temporary layoff, or are offered other reasonable work. Termination without notice is permitted if the employer provides payment in place of having the employee work for their notice period AND the employer keeps contributing to any benefit plans the employee is entitled to for the duration of the notice period. This means an employee can be terminated without notice if they get a lump sum of money that is equivalent to what they would get in an average week multiplied by the number of weeks that their years of employment entitles to them as notice weeks.

Some employees will be entitled to severance pay if they have been terminated. Severance must be paid within seven days of termination or by the next pay day, whichever is later. Employees need to have:

- Been employed for over five years at the place they are being terminated from AND

- The establishment where they are working is going out of business and 50+ people are also being terminated within six months OR

- The employer has a payroll of 2.5+ million dollars annually (usually calculated as being the last fiscal year)

NOTE: Termination and severance of employment are two very similar terms that I use interchangeably here for ease of understanding. They are used in slightly different ways in the ESA itself.

Severance pay is calculated using this equation: (regular weekly wages OR average of last 12 weeks of pay if wages are irregular) X (number of years worked + number of complete months worked/12). Severance pay cannot be more than the sum of regular or average wages worked in 26 weeks. If termination is given without notice, severance pay calculation would include the weeks that would have been worked if proper notice was given. Severance pay can be paid in installments if the employee or the Director of Employment Standards agrees to it, but the installments cannot be over a period greater than three years. Also, if an installment payment is missed, the employee is immediately entitled to the rest of the balance they are owed. Exemptions for severance pay include, but are not limited to:

- Refusal to accept reasonable alternative employment

- Retiring on a full pension that includes the weeks/months/years that would have been worked had employment not ended

- Being employed as a maintenance or construction worker

- Wilful misconduct, disobedience, or major neglect of duties

WHAT TO DO IF YOUR EMPLOYER DOES NOT FOLLOW THE ACT (FILING A CLAIM)

If you believe that you are being denied your rights at work, recommended first steps to take are to document what is being done to you and to seek legal advice. Employees of employers who do not follow the ESA, unless in an exempted job or covered by a union, are entitled to file a claim with the Ministry of Labour or file a lawsuit. Filing a lawsuit can get expensive, however. Claims through the Ministry can be filed online or submitted by mail. Claims must be filed within two years of the alleged ESA violation. The claims process through the Ministry of Labour is only applicable for the Employment Standards Act (ESA), Employment Protection for Foreign Nationals Act (EPFNA), or Protecting Child Performers Act (PCPA). If you are represented by a union and covered by a Collective Agreement, you need to contact your union about violations to your rights as a worker/union member.

If you need assistance with the claims process, or have any questions about the ESA in general, you can call the Employment Standards Information Centre during business hours at:

- 416-326-7160

- Toll free in Ontario: 1-800-531-5551

- TTY (for hearing impaired): 1-866-567-8893

A Brief Introduction to Worker Organizing and Unionization

WHAT IS WORKER ORGANIZING?

Worker organizing is any action that is taken by workers to advance their common interests. Organizing can consist of unionization efforts, educational campaigns, fundraising, striking, blockading/occupying key locations, and much more. Worker organizers understand that the laws are insufficient to protect them and that they can take actions themselves to fix this. Some common issues that workers organize around include:

- Raising the minimum wage to a living wage that increases with inflation

- Paid sick days for all

- Increasing access to unionization

- Increasing regulation and rights for gig workers

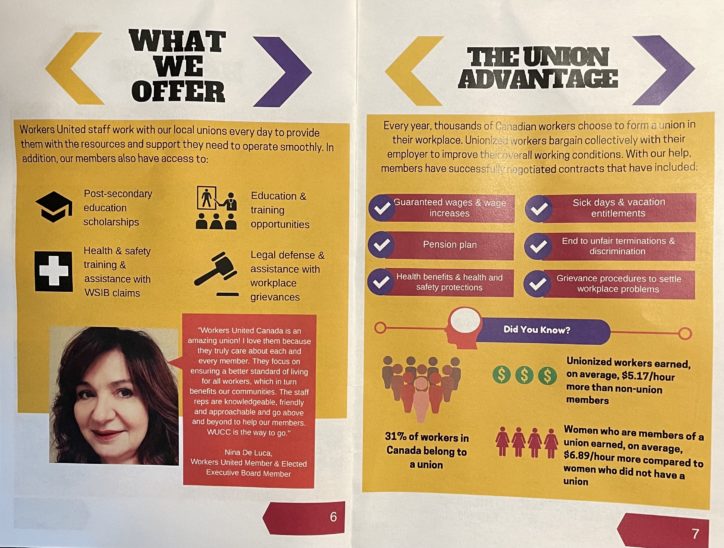

WHAT IS A UNION?

Unions are organizations of workers that establish and maintain increased worker rights. There are two main ways to unionize in Canada:

- To organize with an established union

- To organize an independent union

ABOUT UNIONIZATION

Union members are better paid, get better benefits, get more vacation, and have more job security than those who are not unionized. This is because workers have an increased level of democracy in deciding the terms and conditions of their own employment – so, of course things are going to be better for the workers.

A common misconception that is weaponized as anti-labour propaganda is that unions take your money (dues) and do not meaningfully act in your interests. While there are corruption issues in unions, the single biggest limiting factor to a union’s effectiveness is repressive laws that limit their legal power. For example, members of the Ontario Nurses’ Association (ONA) cannot strike because it is illegal for nurses to do so. This means that members of striking unions in equivalent sectors, like the Ontario Secondary School Teachers’ Federation, have better pay and benefits than nurses. That being said, unions are currently the best, and most realistic, way for workers to protect themselves.

To mitigate the issues associated with unions, we would need a combination of supportive legislation and increased avenues for worker/collective/cooperative ownership.

Forming a union is not as difficult as you might think. The biggest obstacles workers face in forming unions are bosses spreading propaganda and coworkers who do not care. Learn how to form a union in this post I wrote about my experience as a Shoppers Drug Mart employee.

Examples of labour unions in Ontario

Labour unions in Ontario are generally divided by sector and will only help unionize workers in their sector of specialization. Some of the main unions that cover Ontario are:

- Unifor

- Workers United Canada Council

- Canadian Union of Public Employees

- United Food and Commercial Workers

Labour and Legal Resources in Ontario

Legal Aid Ontario (LAO):

- This is a link to all of the legal clinics in Ontario. If you click a hyperlink to the GTA, you can scroll through the different local clinics. They are mostly area-specific, so if you need advice, you should contact the one closest to where you live. https://www.legalaid.on.ca/legal-clinics-list/#s-tor

- General contact for LAO

- 1-800-668-8258 Monday to Friday 8:00 am – 6:00 pm

- info@lao.on.ca

Community & Legal Aid Services Program (CLASP)

- This program is run through York University and is completely free for part- and full-time students. They give assistance for a variety of legal concerns including labour and immigration advice.

- General contact for CLASP

- 416-736-5029 Monday, Wednesday, Thursday 9:30 am – 4:30 pm, Tuesday 9:30 am – 12:30 pm, Friday 12:30 pm – 4:30 pm

Community Legal Education Ontario (CLEO)

- This organisation is dedicated to providing legal education on various topics including labour law. Here is the link to their general page where you can investigate the different sections further: https://www.cleo.on.ca/en/resources-and-publications/resources-topic

Workers’ Action Centre (WAC)

- The Workers’ Action Centre is a non-profit worker organization that does labour advocacy and activism. They run workshops and provide education to the community. Important to include is their multilingual factsheets: https://workersactioncentre.org/resources/

- General contact for WAC

- 416-531-0778 Monday to Friday 12:00 pm – 5:00 pm

- info@workersactioncentre.org

Migrants Resource Centre Canada (MRCC)

- This organization aims at improving conditions for migrant and immigrant workers in Canada. They do research and advocacy, offer educational workshops, and provide services related to labour, health, and immigration for migrant and immigrant workers.

- General contact for MRCC

- Hotline: 1-866-275-4046

- info@migrantsresourcecentre.ca

Parkdale Community Legal Services (PCLS)

- PCLS is a community legal and teaching clinic. They mobilize their resources to fight for social and economic change that is beneficial to workers and the community. It is the largest community legal clinic in Canada.

- General contact for PCLS

- 416-531-2411 Monday, Tuesday, Thursday, Friday 9:00 am – 5:00 pm

- info@parkdalelegal.org

Pro Bono Ontario (PBO)

- PBO is an organization that connects low-income folks with volunteer lawyers to access free legal services. They also support start-ups, artists, social service organizations, and social entrepreneurs with legal issues.

- General contact for PBO

- Free Legal Advice Hotline: 1-855-255-7256 Monday to Friday 9:00am – 5:00 pm

Further Reading

What I have covered in this blogpost is incomplete, general, and meant only as an introductory guide for workers. There are also other laws that affect workers and worker rights in the province. These include the:

- Occupational Health and Safety Act

- Workplace Safety and Insurance Act

- Labour Relations Act

- Pay Equity Act

- Human Rights Code

- Employment Protection for Foreign Nationals Act

- Employment Insurance Act

- Pension Benefits Act

- Protecting Child Performers Act

- Canada Labour Code – for federal employees

Additionally, the Ontario government publishes various guides in plain language that can be used to help comprehend different pieces of legislation. Generally, you can find them by searching “guide to…[put the name of the Act/legal document here]” on an internet browser. Importantly, you will want to scroll to the bottom of any pages you consult of these guides to check the date updated and, if they have not been updated since any new changes have been made to the laws, double check in the official legal document to make sure that they do not contradict each other. An example of one of these guides is Your Guide to the Employment Standards Act.

Conclusion

The government does not make it easy for the average person to access and understand the laws that it makes. This is a concerted effort to disengage and alienate people from the governing process. I hope that this introduction/guide to the Employment Standards Act has been able to help you understand your rights a little better. If you think that anything illegal is happening in your workplace, please reach out to a legal aid resource to confirm it and to help you with next steps. Unfortunately, employers use tactics of intimidation and threats of termination to push people into precarity so that they are afraid to stand up for their rights. The thing is that we need to all stand up for justice or else the same things will just keep happening.

In solidarity,

Christina (she/they)